Gold Price Melbourne 2025 – What Every Melburnian Should Know

You are not alone in this city of Melbourne, in case you are here to search for gold price. It is a booming gold market with prices paying record highs, be it you are buying jewellery on Lonsdale Street, you need to invest in bullion or even consider selling an old gold piece. This is the scoop on what is happening in Melbourne, the reason why it is important and something to monitor.

Current Snapshot – Gold Price in Australia (and what Melburnians are seeing)

Right now in Australia, the spot price of gold (per troy ounce) stands at approximately AUD $6,366 per ounce. melbournegoldcompany.com.au

Breaking that down into grams: that’s around AUD $204.68 per gram (for 24 karat purity) in AUD terms. Market Index+1

Locally in Melbourne, this means if you step into a bullion dealer or jewellery store, the raw gold component is based on these national benchmarks—but with local premiums added.

For example, one live Melbourne‐relevant bullion price list shows a 1 oz cast gold bar selling at around AUD $6,689 and a buy‐back price around AUD $6,364. melbournegoldcompany.com.au

So for Melburnians, the message is: yes, the gold price is high, and the local rates reflect that.

Why the Price is Elevated – What’s Driving It (Especially in Melbourne)

There are a few major drivers—and some local Melbourne flavour to each:

- Global safe-haven demand: In times of economic or geopolitical unrest, gold tends to shine. Investors perceive it as a hedge. As noted by local resources, uncertainty helps to push the price. Market Index+1

- Effects of AUD exchange rate: When you are in Melbourne and spending on AUD, it is going to have effects on how our dollar is performing. In case the Australian currency depreciates, the AUD price of gold will increase.

- Local jewellery & bullion market dynamics: In Melbourne you’ll find high foot traffic in jewellery stores, bullion dealers with live pricing online or in store, and local supply chain factors (manufacture, shipping, retail premiums) that affect what you ultimately pay or receive.

- Resource background to Australia: Due to the traditional history of gold production in Australia (and even in Victoria and other Australian states), gold does have a cultural presence in Australia and local interest can occasionally work to fuel activity (e.g. collecting, prospecting). Most of the production is in WA, but the interest is throughout the country.

- Retail vs wholesale local premiums: on the one hand the raw spot price is one thing, but on the other hand, when you purchase jewellery or retail bars/coins in Melbourne, you pay a premium over the spot prices. On the other hand, in selling scrap you are likely to sell it below spot after deductions. It is important to know that dealers in Melbourne are locals who would charge their margins (to melt, refine, take trade-in).

What It Means for Melbourne Residents

Depending on what you’re doing—buying gold jewellery, investing in bullion, or selling old pieces—the implications vary. Let’s break it down for Melbourne folks.

Buying jewellery in Melbourne

Assuming you are purchasing gold jewellery in Melbourne (in Fitzroy, Melbourne CBD, or the jewellery centres in the suburbs):

- Jewellery cost is probably more expensive than it used to be a year or two ago- the high spot price- so you would want to enquire your jeweller on how much the price is of gold content and the craft/design premium.

- In 18 karat or 22 karat, (as is usual in jewellery) you will pay a reduced purity than 24 k–but the raw material price will follow the high price.

- Locally, inquire questions such as: What are the grams of gold in this piece? What is the purity of which you are using? What markup over spot am I paying to design?

- When you are buying specifically to wear (not invest in), you should consider design, longevity, warranty and even the reputation of the Melbourne outlet instead of gold content.

Buying bullion/investing in Melbourne

If your interest is bullion bars/coins in Melbourne:

- Ensure you’re comparing live spot price (as above) against the actual dealer price in Melbourne. For example: a 1 oz cast bar at AUD $6,689 and buy-back around AUD $6,364 in recent data. melbournegoldcompany.com.au

- Premiums matter. Your margin is the difference between what you are paying and the spot. Lower premium = better value.

- Storage & liquidity: When you purchase bullion in Melbourne, how do you store it? At home safe, bank safe deposit, vault, how can you easily resell it locally back in Melbourne (Melbourne dealers, second-hand market).

- Time horizon: Are you investing for years or just tracking short-term gains? The high price suggests long‐term thinking may be better.

Selling old gold/scrap in Melbourne

If you have jewellery, heirlooms or scrap gold you’re thinking of selling in Melbourne:

- The high spot gold price is good news for you—but remember scrap buyers will deduct refining/melting/refurb costs and apply their margin. So don’t assume you’ll get the full spot price.

- Ask: “What rate do you offer per gram for 24 ct?” “What deductions do you apply?” “What purity are you assuming (24 k, 22 k)?”

- Comparison of buyers in Melbourne: many buyers can differ in their rates. With the current high spot (~AUD $204/gram) you will be interested in making the most out of what you will have in your pocket.

- Timing is everything: The spot price fluctuates so that, unless you are in a hurry you may wait a while and notice the trend but, when you have old gold in your possession, and the price is high at the moment, it is a most favourable time to be there.

Melbourne-Specific Tips & Quick Checklist

Here are practical pointers for those in Melbourne:

- Check live spot price before visiting a Melbourne dealer: Use sites that show AUD spot (e.g., ~AUD $6,366/oz or AUD $204.68/gram). Market Index+1

- Ask for transparency: What purity? What per-gram rate? What deductions or premiums apply?

- Compare at least two Melbourne dealers: Jewellery shops, bullion dealers, scrap buyers—compare quotes.

- Know what you’re paying for: For jewellery, much of the cost may be craft, brand, design—not just gold content. In bullion, ensure you’re not overpaying a big premium.

- Be cautious of rush decisions: Even though the price is high, chasing a “quick flip” without understanding the market can be risky. Know your motivation (wear vs invest vs sell).

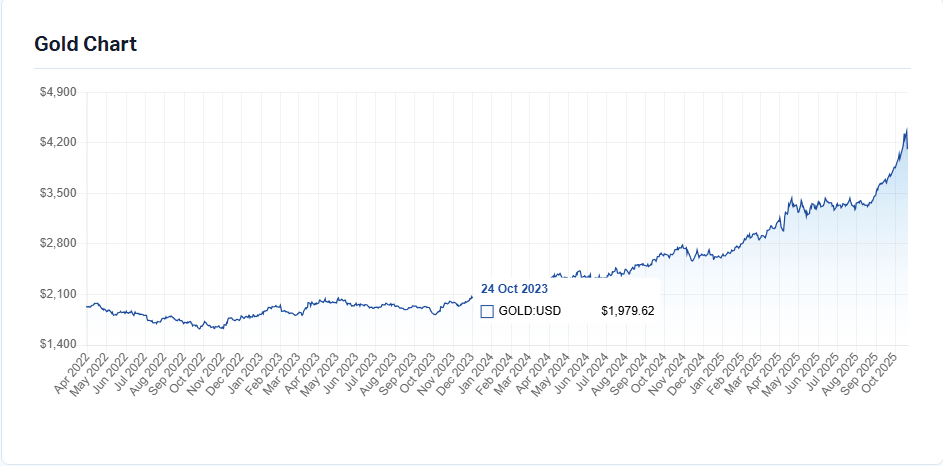

- Keep timing in mind: The gold price swings; for example over the past six months in AUD the gold price rose ~24.8%. Gold Price

- Local reputation matters: In Melbourne choose dealers with strong reviews, good standing, clear policies (especially when selling).

- Record your items: If you’re buying jewellery, document and get appraisal/receipt. If selling, get a quote in writing and check how the buyer calculates.

What Could Happen Next – And What Melbourne Buyers/Sellers Should Watch

When the market watcher of Melbourne considers, the possible scenarios and triggers could be:

- In the event that the Australian dollar appreciates at a large scale, the AUD gold price could go soft (although USD gold could remain flat). It would make it slightly easier to the purchasers in Melbourne.

- When world demand on safe-havens declines (as the economy is stabilized, geopolitical strains are reduced), the gold might be dragged back, hence time is of the essence.

- Conversely, gold might shoot higher in case of any new economic shock or inflationary spike or weak currency- bad news to the holders/ sellers.

- On the local supply and premium movements Melbourne: Watch local bullion dealer supply and premium – In case the bullion dealers run out of stock (because of high demand) the premium you would pay would increase (this is being costly to purchase).

- In the case of jewellery: the shift in design trend, costs of importation, the labour costs in Melbourne may influence the final cost other than the gold content.

- To the sellers: Monitor local scrap market rates, when a large number of people come in with gold at the same time, local margins could narrow.

For Melburnians

The issue at hand is, to the people of Melbourne, the following point – the gold market is at a very interesting crossroad. The spot price is high. You will be trading in a conducive environment whether you are purchasing jewellery as a form of enjoyment, investment in bullions as a future investment or selling scrap jewellery, but only when you go in informed.

- The unrefined amounts: approximately AUD 6,366 per troy ounce (approximately AUD 204.68 per gram) in AUD terms.

- Local Melbourne reality: Higher through higher premiums + local margin.

- Clever strategy: Compare, inquire, know what you are paying/getting.

- When easy, perform, when not, wait–but survey the market.

The gold appetite in Melbourne is still high. The jewellery lanes, bullion dealers and buyer markets are in operation in the city. In case you are in that-knowledge is your greatest property.

Post Comment