Melbourne Rental Market Trends in 2025

Melbourne Rental Market – Trends and Insights for 2025

The competition level in Melbourne’s rental market remains strong in 2025 while recent extreme pressures within the market continue to relieve. The rental market forecast shows that increases in 2022–2023 rent prices will stabilize following their unprecedented rise. The following report fully examines present market conditions by studying future rental predictions alongside supply and demand patterns and significant aspects along with changes in tenants’ conduct and comparisons from previous years and policy adjustments and innovative market trends which shape Melbourne’s housing rental environment.

Rental Price Trends Across Melbourne

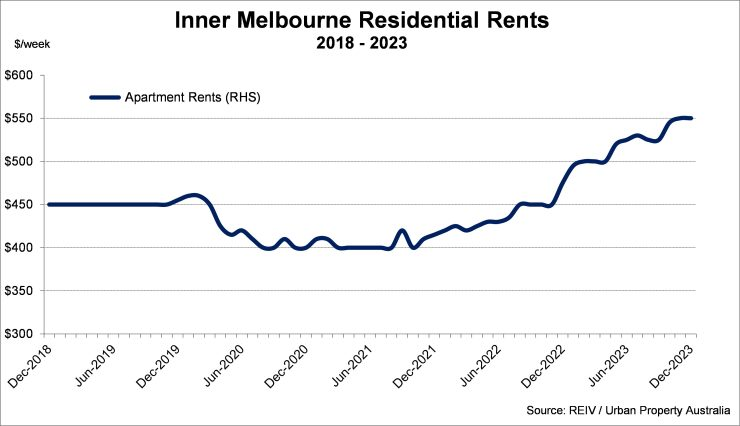

The rapid increase in Melbourne rental prices has ended after two consecutive years of significant upsurge. The longest rental price growth streak of recent times reached its conclusion when median asking rents stabilized in late 2024. The housing rental market demonstrated a 15% growth while unit rentals increased by 16% during 2023 yet both rates have decreased since then. CoreLogic statistics show that Melbourne rental prices growth decreased from double-digit levels in 2023 to approximately 4% in 2024 marking market peak exhaustion.

Experts forecast that the coming year will bring less intense rental growth as opposed to another rent boom. Prospective highest growth rates in rental costs are now viewed as improbable owing to increasing affordability issues. Future projections indicate that rental prices will rise at a pace parallel to inflation rates throughout the next few years at a low-to-mid single digit range. The rental market trends vary across different geographical locations.

- The residential demand for inner-city apartments will continue growing at a moderated rate because young professionals and international students demonstrate strong interest in this sector.

- Family homeownership in suburban areas is expected to experience reduced rent appreciation because tenants are contemplating buying properties rather than renting.

- The Melbourne rental market continues to offer lower prices relative to Sydney and other capital cities even though property rates become increasingly similar in each market.

The typical weekly dwelling rent in Melbourne reached $604 in 2024 which placed it behind Hobart for Australia’s cheapest rental cities. Rental costs in 2025 hold steady at high figures following the stabilization of prices that experienced rapid increases in the recent past.

Supply and Demand Dynamics

High demand surpasses available supply thereby creating the rental crunch throughout Melbourne. The state of Victoria holds the highest migration numbers in the country following the pandemic while simultaneously experiencing rapid population growth. The number of state residents increased by 181,000 residents in the year through June 2023 representing a 2.7% growth due to international students as well as skilled migrants and returning Australians who typically choose renting for accommodation.

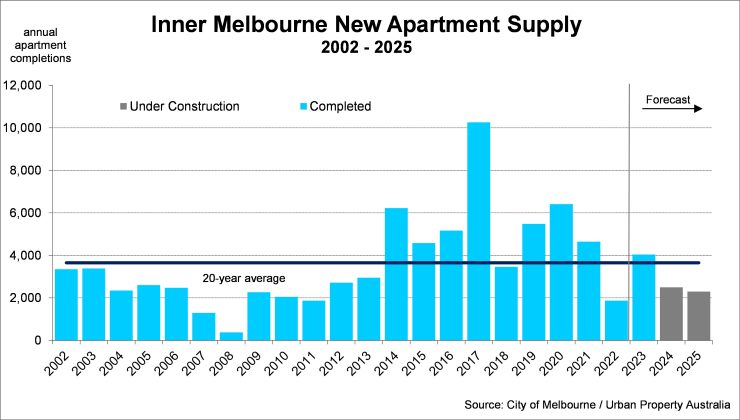

The current housing market faces a challenge because residential construction projects are falling short of demand. Victoria reached an all-time low rate of new dwelling completions in 2024 because builders fell 15% shorter than the average completion rate throughout the last ten years because of increasing expenses and workforce issues and delayed planning processes. Inner Melbourne added around 4,000 apartments in 2023, slightly above average, but this number is expected to drop to ~2,500 in 2024–2025, many being build-to-rent projects. Low supply of rental units prevents vacancy rates from reaching equilibrium and maintains rates at 1.2% by late 2024 while the market requires rates above 2–3%.

The rental market in Melbourne will stay tight since a major boost in new housing development must happen before rental prices will recover.

Key Factors Influencing the Rental Market in 2025

Multiple factors will affect the rental market conditions set for 2025. Several elements form the characteristics of Melbourne’s current rental market.

- The high interest rates create a barrier for home purchase decisions thus renters continue to remain in high demand. Future predicted interest rate reductions might allow some potential homeowners to buy during mid-2025 which would lessen pressure on rental demand.

- The rental demand in Melbourne remains strong because the city maintains high growth in both migrant and international student populations. The city will become Australia’s biggest metropolis during upcoming decades and this will boost its overall housing needs permanently.

- Scarce housing supply combined with high building expenses and time-consuming planning procedures reduce the rental stock which results in stubbornly low vacancy rates.

- Strict governmental rental rules and constructive housing development policies and short-term rental regulations particularly targeting Airbnb affect the market conditions.

Changing Tenant Preferences and Behaviors

- A considerable portion of Melbourne tenants continue adapting their housing alternatives because rental costs stay elevated.

- The trend toward shared housing arrangements among tenants continues to grow since they can combine expenses effectively thus canceling the pandemic-era trend of downsized residences.

- The rising rental costs have led Melbournians to choose between spending less money on accommodation by getting properties in older buildings away from city centers.

- Renter success in obtaining rentals requires proposing longer landlord agreements alongside paying rent in advance in markets with intense competition.

Comparisons with Previous Years

The rental market in Melbourne evolved substantially since the time before the pandemic hit in 2025. The rental vacancy rates stayed at the balanced level of 2–3% prior to the COVID-19 pandemic. The inner Melbourne rental vacancies surged during the pandemic period to reach a peak of 9% in the CBD before market demand reached new highs thus triggering extreme rental growth in the 2022–2023 period. The rental market experienced initial signs of relief in 2024 but conditions became worse than they were in 2019 due to higher prices and lower rates than past norms.

Policy Changes Affecting Rentals

The rental market in Victoria has experienced various policy alterations from the government.

- Renter Protections:Local policies now provide better protections for renters through banning arbitrary evictions and establishing property safety rules while restricting rental hikes.

- Short-Stay Accommodation Levy: The Short-Stay Accommodation Levy introduced a 7.5% charge on Airbnb rentals which started in January 2025 to motivate property owners into restoring their properties for standard long-term leasing.

- Housing Supply Incentives: The government introduced initiatives like stamp duty exemptions for new-build apartments combined with rapid planning procedures in order to stimulate housing construction.

- First-Home Buyer Support: Shared equity schemes and grants are helping some renters transition to homeownership, gradually easing rental demand.

Emerging Trends – Build-to-Rent Developments

The rental market in Melbourne has experienced a substantial evolutionary change through the creation of build-to-rent (BTR) developments. Professional management in BTR properties sets them apart from traditional rentals since they provide residents with secure long-term housing solutions together with upgraded amenities. Developers have made Melbourne the national leader for BTR property development since multiple projects continue throughout the inner area. Although these new residential schemes will create hundreds of new rental units, experts suggest that increasing demand for rental properties continues to exceed current supply levels thus BTR projects cannot alone solve Melbourne’s housing deficiency.

Rental Affordability Concerns

Despite market stabilization, rental affordability remains a pressing issue. The rental affordability index of Melbourne reached its lowest point ever in 2024 because tenants spent close to one-third of their income on rent. People who receive welfare benefits live in extreme housing crisis because there is no affordable housing available to them. The problem of overcrowding and homelessness grew worse because of these circumstances.

Rental affordability demands both an expansion of rental stock and specific affordability strategies beyond limited improvements in vacancy rates.

Top Tips for Renting in Melbourne in 2025

- Be Ready to Apply Quickly – Rental competition is fierce, so have your documents prepared.

- Explore More Affordable Suburbs – Areas like Pakenham, Sunbury, and Melton offer lower rental prices.

- Consider Build-to-Rent Developments – These offer better amenities and long-term security.

- Negotiate Your Lease – Try securing longer-term leases to avoid rent hikes.

- Know Your Tenant Rights – Stay updated on Victoria’s rental laws to ensure fair treatment.

Melbourne’s Rental Market in 2025

Melbourne’s rental market remains competitive, but the rapid price hikes of recent years are slowing down. While affordability remains a challenge, government policies, build-to-rent projects, and an increase in rental listings may provide some relief in the coming years.

For renters, flexibility in location and living arrangements can help navigate high costs. For landlords, demand remains strong, but understanding new rental regulations is crucial.

Melbourne’s rental market in 2025 remains challenging, with rents still high but showing signs of stabilization. The fundamental issue of supply struggling to meet demand continues to drive competition, keeping vacancy rates low. While government policies, build-to-rent projects, and economic shifts may help rebalance the market over time, affordability remains a significant concern. Renters are adapting by seeking shared housing, adjusting location preferences, and negotiating leases strategically. Until a substantial increase in housing supply materializes, Melbourne’s rental market is expected to remain tight but less volatile than in previous years.

Looking for a rental in Melbourne? Stay informed with the latest updates and trends by following our blog!

More Details for – Rental Market Information in Melbourne

- Consumer Affairs Victoria (CAV)

- Department of Families, Fairness and Housing (DFFH)

- MRE | Melbourne Real Estate

Visit Everything in Melbourne

Post Comment